Instant Digital Onboarding – A New Reality, Part I

(4-minute reading)

Instant Digital Onboarding – A New Reality

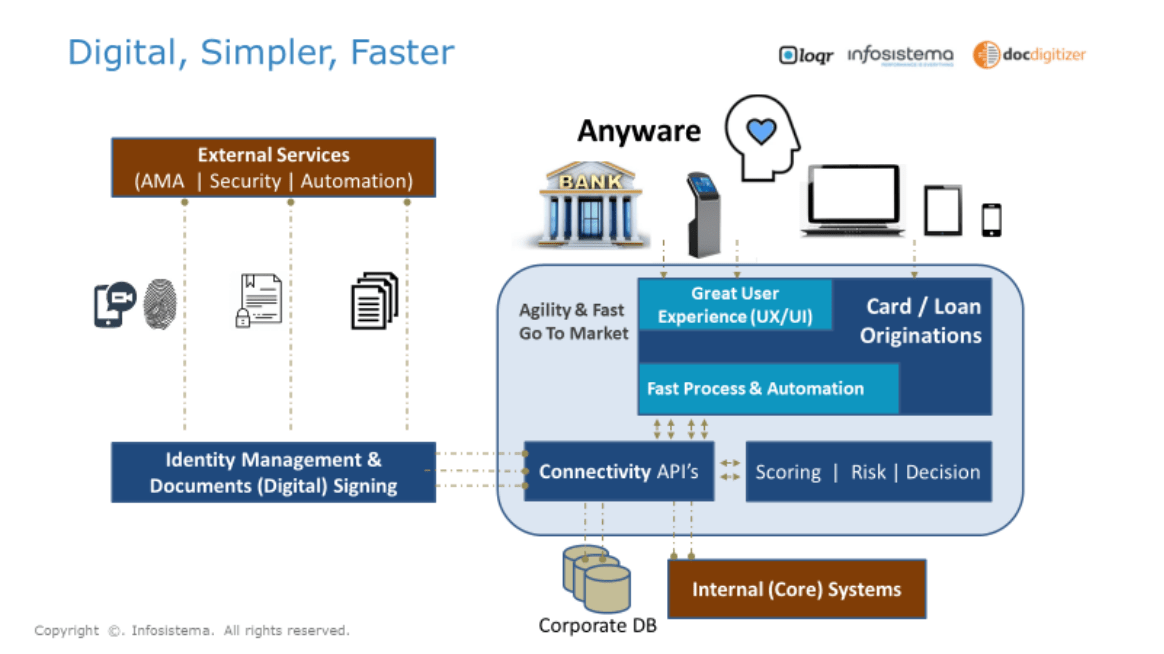

Customers demand a higher level of digital services and personalized interactions from their financial providers. This means a much higher digitalization level for financial services (bank, insurance) must be available and simple to use when needed. Open Banking and the PSD2 regulation motivate higher competition between financial services providers and bring a new world of aggregation and simplification to customers, reducing their loyalty to current providers.

The experience of opening a new bank account or taking out a new loan can be very complex and time-consuming. This is often exacerbated by the multiple questions, types of information, and documents that banks require during the process, some based on external legal impositions and others simply because there is a lack of innovation and the processes haven’t been optimized yet. This results in a very poor customer experience, leading to many friction points such as being re-routed to different channels, the need to provide physical identification, answering the same questions multiple times, and long delays to access the account.

Improving the customer onboarding experience should be a priority for financial institutions, especially as new regulations like the PSD2 will enable customers to change their financial service provider more easily. The account setup should now be a formality and, therefore, be completed in minutes like other common services.

Onboarding is the first customer interaction and will set the tone for the entire relationship going forward. The move from a lengthy (a couple of weeks), paper-based and inconvenient process to a smooth (a couple of hours) and omnichannel customer experience would be a true game-changer, not to mention it could potentially save significant process costs.

Customer onboarding starts with their initial research for information on a financial institution to the time the product is activated (credited account or received a card). This includes all of the touchpoints and communications with the customer and all the related context (CRM). Some of the key moments are the price simulation (quote), followed by a proposal (including the risk assessment) and finally the contract, with compliance (KYC) and signatures. This process typically takes a couple of weeks in the most traditional form, with a lot of paperwork and the risk of losing many prospect customers along the way.

The top 3 challenges for today’s traditional onboarding process:

1. Decreasing cost/income ratio

2. Customers’ behavior is evolving, and people don’t want

to go to a branch anymore

3. Newmarket entrants (FinTech & others)

The cost/income ratio can be significantly decreased from the market average of 65% (ref) by simplification and automation, which also improves user experience and customer satisfaction. Today’s technology is already in use by FinTech’s that challenge incumbent financial providers by offering automation and process simplification, sometimes against some established rules imposed by compliance departments. Some of those rules are actually obsolete, but compliance teams also aren’t experts in how to change processes with technology-based innovation and keep the compliance requirements all at the same time.

The most amazing side effect of the adoption of a digital onboarding process from the customer’s perspective is the greater flexibility and user experience that it brings.

Customers’ behavior is changing dramatically as they became more international and mobile, demanding an immediate response from their financial providers and a much simpler process, without the paperwork. They search for more flexibility and convenience in the time and channel they prefer to interact, avoiding physical branches or face-to-face interactions. 38% of customers cite frustration with paperwork or the volume of information required as the cause of them dropping out of the onboarding process. Industry challengers like FinTech’s and some other new market entrants are reshaping the landscape of financial services providers, supported in the adoption of new technology and processes. FinTech’s introduce automation to significantly decrease their operational costs and deliver financial products with greater agility and speed, while incumbents resist change and lag behind their customer base’s expectations in this new digital world that forces a faster market change.

@Jorge G. Pereira, Co-Founder e CEO at Infosistema

Thirsthy for Knowledge? Subscribe to our Newsletter and Never Miss Another Byte!

Related Content: Credit and AI: the future for Loan Origination in 2019