Blockchain… a promising tool to improve process optimization, control and transparency

In just a few decades, technology has evolved so rapidly and has become so intrinsically incorporated into our lives that it is hard for us to conceive a society and a day-to-day life without a digital presence. The business models themselves have evolved greatly thanks to the innovation, speed and security promoted by the many technological solutions that appear in the market and that undoubtedly improve the efficiency and performance of organizations in an increasingly competitive and variable scenario.

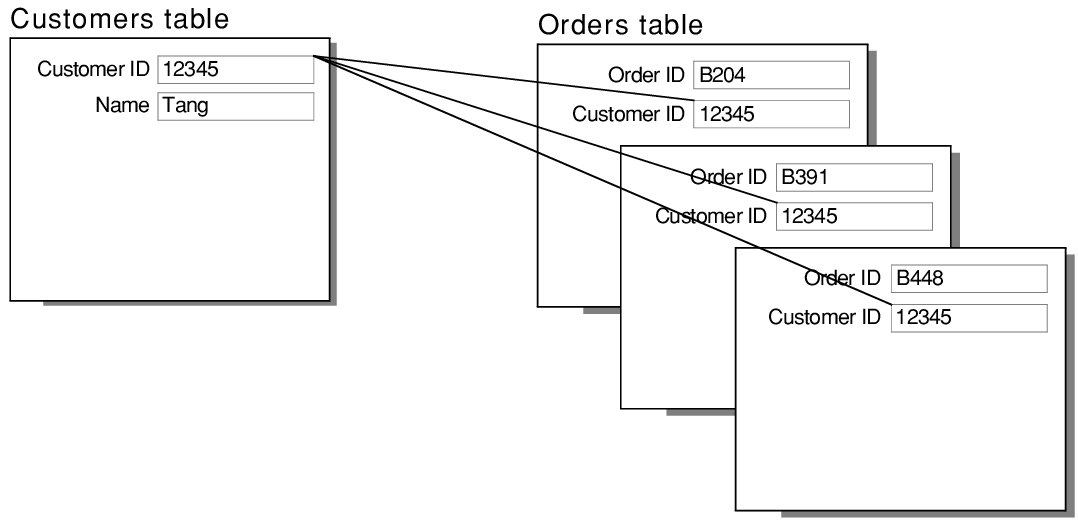

Surely, you’ve heard of Bitcoin, but will you know its basis – Blockchain? The Blockchain is a math-based process that allows you to create an “anything digital" record by keeping it in a sequence or history in an inviolable way – thus ensuring the entire history of the information stream. Blockchain can be public or private; it allows you to send information and its control in a “collaborative" / distributed way (it eliminates the need for an entity that guarantees information trust). A September 2015 World Economic Forum report predicted that, by 2025, 10% of GDP will be stored in technology related to Blockchain, and that, before that, governments will be taxing through technology.

Surely, you’ve heard of Bitcoin, but will you know its basis – Blockchain? The Blockchain is a math-based process that allows you to create an “anything digital" record by keeping it in a sequence or history in an inviolable way – thus ensuring the entire history of the information stream. Blockchain can be public or private; it allows you to send information and its control in a “collaborative" / distributed way (it eliminates the need for an entity that guarantees information trust). A September 2015 World Economic Forum report predicted that, by 2025, 10% of GDP will be stored in technology related to Blockchain, and that, before that, governments will be taxing through technology.Possible uses are, for example, in Health, where medical information that evolves over time has an unchanging past, or in Banking – reducing fraud, reducing costs in KYC processes, reducing intermediaries in payments or trading platforms (with NASDAQ and Australian Securities Exchange already exploring solutions).

Another area still in operation is the one of the smart contracts. Because Blockchain can store any digital information, including program code, it is possible to automate processes that use technology to ensure that when certain conditions are created, something happens – the delivery of a product may deploy the payment of an invoice, the payment of an income occurs after submitting an access code, etc.

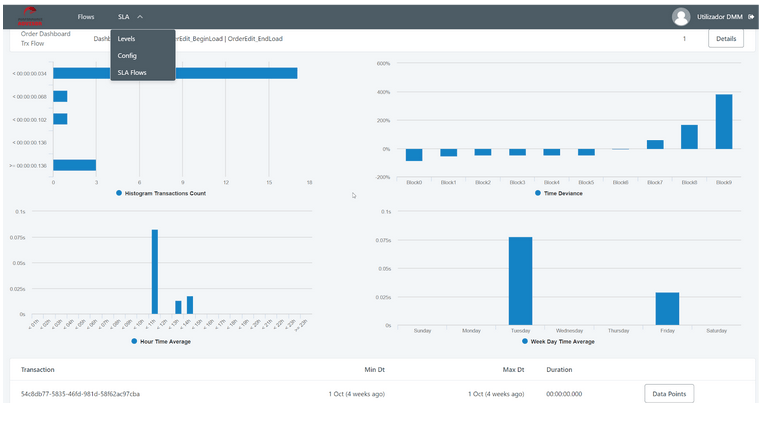

According to a report by McKinsey,* there are already some players in the market such as DHL, Citibank, Western Union and the Bank of America who have taken advantage of the benefits of this technology to reduce operating costs and fees, increase transparency, speed and security, with clear impacts on their costs, revenues and capital. Thanks to this technology, in fact, they identify the potential of optimizing billions of euros in the insurance industry through process optimization – something that in this industry, in fierce competition, every insurer needs to increase competitiveness. And we already have Blockchain-as-a-Service platforms, allowing a rapid adherence to technology.

As with all “fashionable" technologies, it is essential to assess their advantages and where they are applicable. There are no silver bullets, and there are many cases where Blockchain does not make sense – as data protection issues (with GDPR regulations) make us understand, keeping information immutable and available with no possibility of being removed may be an impediment to certain ideas. And the term “smart contracts" is misleading because they are neither smart (or just as clever as a set of codified rules) nor legally binding contracts (for now, they require “mixes" with the traditional “paper contract").

Save information and prove it is unchanging. Enable reliable transactions without the need for verification institutions. Eliminate intermediates. Cut costs. Archive with complete, inviolable and up-to-date registration. Transparency, speed and agility in operations. And an enormous capacity to transform the business and improve its infrastructure. This is what we anticipate: a huge potential that is about to happen. Everything happens at breakneck speed, the world accelerates, and we with it, and quickly the proofs of concept make the leap into the production phase. Therefore… research, design, test and face the new challenges of the market using the latest technologies!

*McKinsey & Company – Blockchain Technology in the Insurance Sector. Quarterly meeting of the Federal Advisory Committee on Insurance (FACI)

Bruno Costa, Global Services Manager na Infosistema