Open Banking / PSD2

The Movement That is Changing

Retail Banking

The Movement That is Changing Retail Banking

What is Open Banking and PSD2?

Open banking refers to a series of reforms to how banks deal with financial information. It arrived alongside a regulation in Europe named “the second Payment Services Directive” (PSD2), which came into effect on January 13th, 2018, and was mandatory for banks to implement before September 14th, 2019.

Open banking is the practice of sharing financial information electronically, securely, and with the customer’s prior approval. Application Programming Interfaces (APIs) allow third parties to access financial information efficiently, hence leveraging the development of new apps and services. For any third party to have access to customer data, the customer will have to first opt-in.

The mandatory/regulatory adoption of PSD2 means that banks are required to give their customers access to their own data, subsequently allowing customers to provide that data to third-party entities.

Why is it important?

Data is key! The most important asset in the world today—and banking data is the “cream of the crop,” since it provides insights into how, where, and when consumers and businesses spend money, invest, and ask for credit.

Open banking allows for a myriad of third-party services to aggregate data from multiple financial institutions and let consumers analyze their spending and earnings, allowing them to better budget for the future. This was the first “common” use of the newly available information.

Other uses will surely arise or be more commonly adopted soon, with incumbents and new entrants vying for new opportunities, revenues, and information.

Encouraging competition

Alongside this disruptive change, open banking is currently encouraging greater competition between banks (and other fintech solutions) as they all battle to provide consumers with the best tech to manage their money and the best customer service to accompany it.

While open banking is not destroying traditional banking, it is instead giving customers more power to switch providers and pick products, meaning banks are facing stiffer competition.

Competition comes from:

- Other banks, who now aggregate multiple bank accounts in their online banking apps.

- User-friendly rivals and innovative fintechs, such as aggregators or new entrants like Revolut.

- Established tech-giants moving into the banking space, for example, Facebook with their new digital coin Libra, Apple Pay, or Samsung Pay.

- Well-known consumer service companies with good customer relationships like retail chains are starting to offer prepaid cards.

Driving up security

Open banking is very secure and drives up the security requirements of financial institutions—essentially, it is at least as secure as online banking.

The Open Banking API endpoints deployed by banks go through extensive testing by both the banks and authorized and regulated third parties.

Open banking fosters new techniques for identity verification and fraud prevention, creating important opportunities for banks’ open API initiatives. As it happens with any other new banking channel, risks of data loss, identity theft, data protection violations, money laundering, and financing terrorism must be considered and dealt with.

Here to stay

The current offering in open banking by most institutions is limited to the lowest common denominator—the regulatory requirements of PSD2, i.e. providing access to a client’s payment account and allowing for payment initiation (PIS) and account information (AIS) services by PISP and AISP providers respectively.

Most incumbent banks see this new channel and APIs as a threat, so they simply fulfill the regulatory requirement—these mandatory APIs cannot be monetized and have to be made available for free by the banks. Ideas to further monetize and create new revenue streams for banks have been scarce until now.

However, not only do the regulatory requirements guarantee that open banking is here to stay, but also the competition creates pressure on the banks who are more defensive to go forward with their API initiatives:

- Either because it has a product or service where it has a competitive advantage, so it is in their best interest to provide another channel for distribution;

- Or to seek integrations with new sales channels, for example, integration with point of sales systems for easier credit or with business management and popular bookkeeping solutions and ERPs, allowing business users to more easily and efficiently execute banking operations.

Our Products

- API management solution, fully PSD2 compliant.

- Account aggregation solution for Openbanking UK, Berlin Group, and other formats.

- Payments HUB solution, implementing Instant Payments or ISO20022 message formats, applicable for SWIFT, Target / AT2, SEPA CT, and SEPA DD.

- All the tools you need for your financial messaging projects (Build, Validate, Translate your SWIFT MT, ISO20022, SEPA, CBPR+ messages)

Our Solutions

Our SaaS /

API-driven Services

- www.BizAPIs.com

- PSD2 Aggregator Service

- Certidão Permanente information API

- IRS structured data and document API

- CMD (Chave Móvel Digital) integration API

- CRC extractor API

- DocDigitizer – automatic document data extraction API

- IES (Informação Empresarial Simplificada) structured data and document API

- AMA (Agência para a Modernização Administrativa) data for Segurança Social (SS) and Caixa Geral Aposentações (CGA)

- TAE self-service Simulator

News

- September 12, 2019

Banco Invest Chooses Infosistema and aplonAPI for PSD2 Compliance

- August 7, 2019

- July 18, 2019

- July 12, 2019

- June 6, 2019

- January 25, 2019

- January 17, 2019

Banco Carregosa chooses Infosistema and aplonAPI for PSD2 compliance

Infosistema can help

Define information systems’ strategy and service architecture.

Provide a software accelerator for the control, disclosure, and management of APIs and access.

Reduce time-to-market for PSD2 and Open Banking initiatives.

Integrate core systems.

Manage the full process cycle—from the APIs publication to fintech connection and client use.

Infosistema’s strategic partnership with PaymentComponents Ltd

Together we provide a robust solution to address the main concerns regarding full PSD2 regulatory implementation and the open banking challenges ahead.

We power a modern Platform Banking Services with a set of payment and account reporting APIs, delivered in a complete API Framework.

Our Platform Banking solution was made for banks to cover PSD2 and BaaP needs and handles ALL legacy SWIFT MTs or new generation ISO20022 messages and Instant Payments in a unified, modern, and elegant way.

These Solutions Allow You to:

Build

- A complete set of ready APIs to use immediately

- The Flexible Connectivity Layer of our API Management System connects to existing core systems

- Easily add yours or other custom APIs to facilitate your digital projects

- Everything you need to run internal or public bank APIs that are PSD2 compliant

Manage

- An API Store to administer multiple exposed APIs

- Granular Management to quickly and easily control users’ Roles and Permissions

- Register Client Apps to safeguard API access

- Real-time Usage Logging for detailed Auditing and Reporting

Distribute

- API Developer’s Portal with complete documentation and code examples

- Streamlined Registration process, fully integrated with API Management Module

- Sandbox environment facilitates agile development with minimal required support

- Customizable UI allows seamless integration with your website

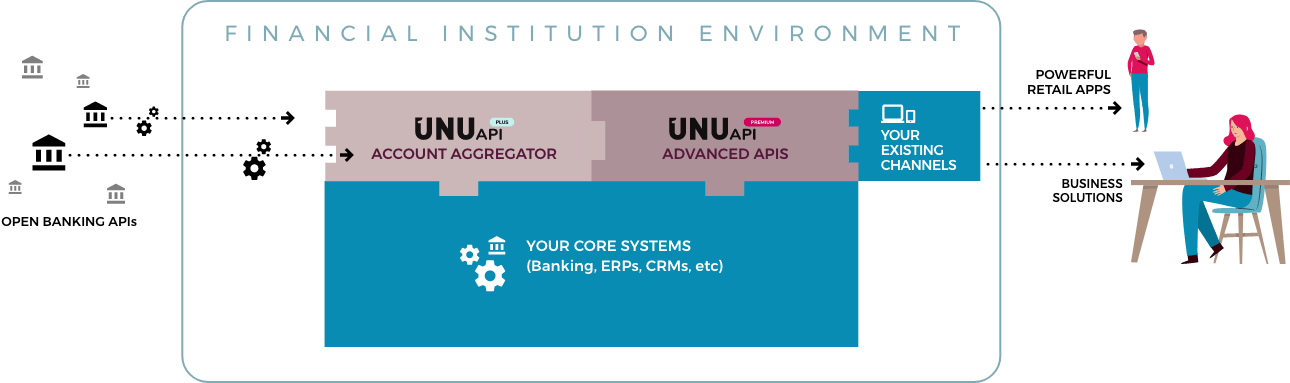

Accounts Aggregator

UNUapi Plus—Provides the necessary ingredients to harvest the available open banking APIs out there. Connect to multiple banks as easily as connecting to just one.

UNUapi Premium—Build your own Business Financial Manager using our advanced APIs and premium components. Enrich your web or mobile apps with APIs that “think.”

Payments HUB

aplonHUB—The easiest way to add payment functionality to your core system! Provides instant payments and ISO20022 migration with just a plug-in application. Manage SEPA, SWIFT, and ISO20022 messages with a web-based end-to-end solution providing efficiency, flexibility, and seamless integration. aplonHUB covers all types of processing activity for complex, high-value international payments, domestic, SEPA, and instant payments.

Payments HUB

aplonHUB—The easiest way to add payment functionality to your core system! Provides instant payments and ISO20022 migration with just a plug-in application. Manage SEPA, SWIFT, and ISO20022 messages with a web-based end-to-end solution providing efficiency, flexibility, and seamless integration. aplonHUB covers all types of processing activity for complex, high-value international payments, domestic, SEPA, and instant payments.

FINaplo:

Build, Validate, Translate your SWIFT MT, ISO20022, SEPA, CBPR+ messages

Online Validation Service, For those that need to validate SWIFT, ISO20022 and SEPA messages with a simple signup.

API Validation Service, For developers that need to work with thousands of messages in seconds with their own application

Embedded SDKs, For companies that want to embed our SDK or APIs in their own environment