Discover our world

Top 3 Benefits Organizations Can Get from Open Banking

Open Banking is a new way of thinking, bringing the opportunity for a rebirth of the financial industry. The moment has come for challengers to make their move and start using new Open API’s.

Cybersecurity in the Financial Sector BdP

Infosistema was invited to be a part of the conference “Cyber-Resilience in the Financial Sector”, organized by Banco de Portugal, regarding cybersecurity.

Credit and AI: the future for Loan Origination in 2019

What does AI have to do with credit? Where should banks operate? How can better use of technology streamline processes and satisfy the end consumer?

5 Things Board Executives Need To Know About Personal Liability

Executives and board members are subject to new levels of personal responsibility and liability every day.Regulatory authorities have made it clear they intend to focus on individual accountability.

5 Leading Fintechs on Customer Experience and Digital Onboarding

Everyone knows Revolut and N26, that brought the ability to open a bank account and get a free credit card within 5 minutes, anywhere you may be, using only your smartphone, a selfie and a photo of your ID card.

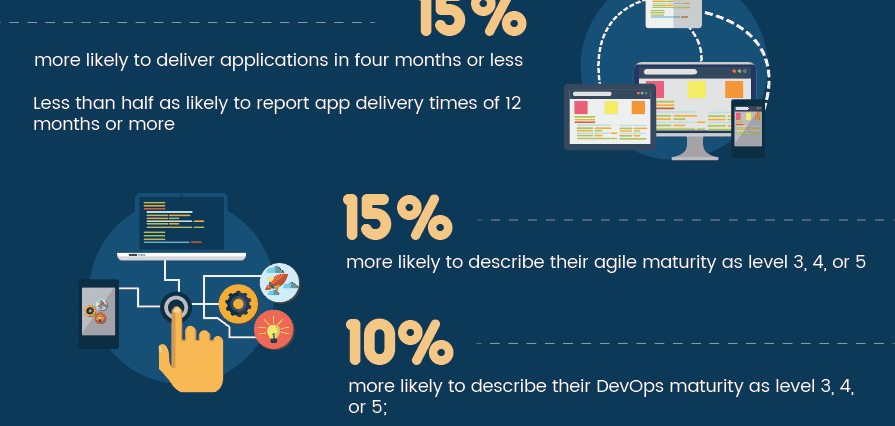

Digital Transformation and the Case for Low-Code

OutSystems sent a survey to IT professionals from all over the world, and more than 3,500 from 116 countries responded. They answered questions on the priorities and challenges for application development and the strategies they are using to speed-up delivery—and whether these strategies are working.

Project in Big Data Paradigm

Execute monthly scoring models that will suggest an increase or decrease of credit lines for bank clients based on their historical financial data

Blockchain… a promising tool to improve process optimization, control and transparency

Blockchain is a math-based process that allows you to create an “anything digital” record by keeping it in a sequence or history in an inviolable way.

How-to Simplify and Innovate with Tech Automation?

Business innovation and simplification are growing challenges driven by the diversity of technologies and skills to maintain and develop business solutions.

Infosistema implements Auto Insurance Sales Process integrating Banking and Insurance

The objective was to increase the billing of both entities involved, through the integration of a simulator of the Insurer within a banking platform.